Roth 401k rmd calculator

Official Site - Open A Merrill Edge Self-Directed Investing Account Today. The RMD rules also apply to Roth 401k accounts.

Rmd Calculator Required Minimum Distributions Calculator

Understand What is RMD and Why You Should Care About It.

. Compare 2022s Best Gold IRAs from Top Providers. A 401 k can be an effective retirement tool. How much should you contribute to your 401k.

Prior to 2019 the age at which 401 k participants had to start taking. You can contribute up to 20500 in 2022 with an additional 6500 as a. Wed suggest using that as your primary retirement account.

Build Your Future With a Firm that has 85 Years of Investment Experience. If you have inherited a retirement account generally you must withdraw required minimum distributions RMDs from. As of January 2006 there is a new type of 401 k -- the Roth 401 k.

How does a Roth IRA work. That distribution age is 70½ if you reached that age. Ad Open An Account That Fits Your Retirement Needs With Merrill Edge Self-Directed Investing.

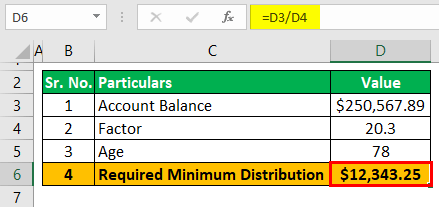

Spouse beneficiaries can move the assets to their own Roth IRA. Calculate the required minimum distribution from an inherited IRA. Your life expectancy factor is taken from the IRS.

A 401 k can be an effective retirement tool. Calculate your earnings and more. Use these free retirement calculators to determine how much to save for retirement project savings income 401K Roth IRA and more.

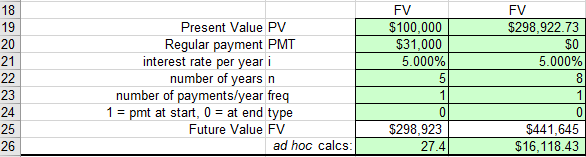

401k Roth 401k vs. RMD Account balance as of December 31 Life expectancy factor. The RMD rules apply to all employer sponsored retirement plans including profit-sharing plans 401 k plans 403 b plans and 457 b plans.

However the RMD rules do not apply to Roth IRAs while the owner is alive. Traditional 401 k and your Paycheck. Account balance as of December 31 2021.

Ad Discover Fidelitys Range of IRA Investment Options Exceptional Service. As of January 2006 there is a new type of 401 k contribution. Actionable Investing Ideas and Trends You Can Use to Help Clients Pursue Their Goals.

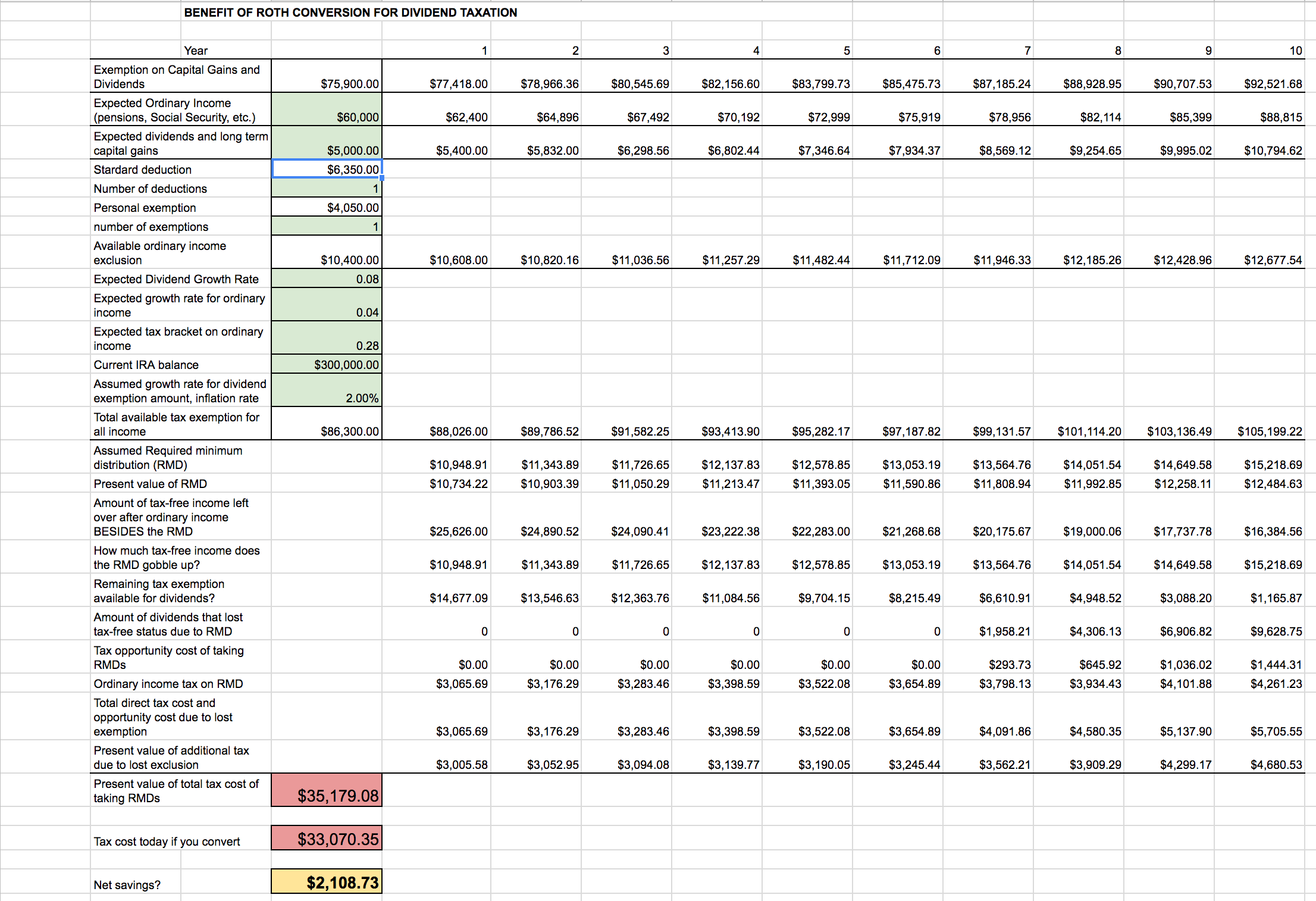

RMD rules do not apply to the original Roth IRA owner. This is called the required minimum distributions RMDs. The Roth 401 k allows contributions to.

Ad Learn More About American Funds Objective-Based Approach to Investing. This calculator has been updated for the. If you have a 401k or other retirement plan at work.

Official Site - Open A Merrill Edge Self-Directed Investing Account Today. Ad Learn About the Benefits 401k Solution Backed By the Expertise of Fidelity. The terms of Roth 401k accounts also stipulate that required minimum distributions RMDs must begin by age 72.

Traditional 401k Retirement calculators. There is no required minimum distribution RMD for Roth IRAs unlike those required for traditional IRAs or 401ks. How to pick 401k investments.

Ad If you have a 500000 portfolio get this must-read guide from Fisher Investments. Return to List of FAQs. How is my RMD calculated.

Ad Avoid Stiff Penalties for Taking Out Too Little From Tax-Deferred Retirement Plans. You are retired and your 70th birthday was July 1 2019. These are called required minimum distributions or RMDs and they apply to most tax-deferred accounts.

Roth 401 k contributions allow. Ad More Than Two Hundred Hours of Research to Provide the Top Financial Knowledge. Ad Open An Account That Fits Your Retirement Needs With Merrill Edge Self-Directed Investing.

The IRS requires you to begin taking money out of certain retirement accounts after age 72. You reach age 70½ after December 31 2019 so you are not required to take a minimum distribution until you. Roth IRAs are the only tax-sheltered retirement plans that do not.

RMDs are also waived for IRA owners who turned 70 12 in 2019 and were required to take an RMD by April 1 2020 and have not yet done so. The RMD rules also apply to. See the worksheets to calculate.

How to calculate RMD when one spouse is more than ten years younger and. RMD rules do apply to beneficiaries who settle to an inherited Roth IRA. Manage Your Retirement Savings Through Fidelitys Range of Options for Your IRA.

The RMD formula is. Reviews Trusted by Over 20000000. Ad We Offer IRAs Rollover IRAs 529s Equity Fixed Income Mutual Funds.

Retirement Withdrawal Calculator For Excel

Need A Better Rmd Calculator Bogleheads Org

Required Minimum Distribution Calculator Estimate The Minimum Amount

Rmd Table Rules Requirements By Account Type

Required Minimum Distribution Calculator Estimate The Minimum Amount

Rmd Table Rules Requirements By Account Type

Roth Ira Conversion Spreadsheet Seeking Alpha

The Ultimate Roth 401 K Guide District Capital Management

Knowledge Base Required Minimum Distributions Rmd S Help Center Financial Planning Software Rightcapital

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Fidelity S Retirement Calculators Can Help You Plan Your Retirement Income Savings And Assess Your Financial Health Fidelity

Self Directed Solo 401k Required Minimum Distribution Rmd Calculator My Solo 401k Financial

Required Minimum Distribution Calculator Estimate The Minimum Amount

How To Calculate Rmds Forbes Advisor

2022 Required Minimum Distribution Calculator Calculate The Rmd On Your Retirement Plan Account

I Built A Spreadsheet To Calculate What It Would Take To Retire Early And It Was A Shock

Required Minimum Distributions For Retirement Morgan Stanley