401k contribution tax deduction calculator

Use this online calculator to see how much of your Social Security benefits is taxable and how much of it is tax-free. One-half of your self-employment tax and.

How Much Can I Contribute To My Self Employed 401k Plan

Your principal grows tax-free.

. Follow this link for the information you need about contribution limits for the tax year 2021. Contributions are easy because they automatically come out of your paycheck. For self-employed people a solo 401k may offer greater annual contribution limits and bigger tax deductions than a SEP IRA depending on your income.

The standard deduction dollar amount is 12950 for single households and 25900 for married couples filing jointly for the tax year 2022. This contribution limit includes deferrals that you elect to be withheld from your paycheck and invested in your 401k on a pre-tax basis. You can only contribute a certain amount to your 401k each year.

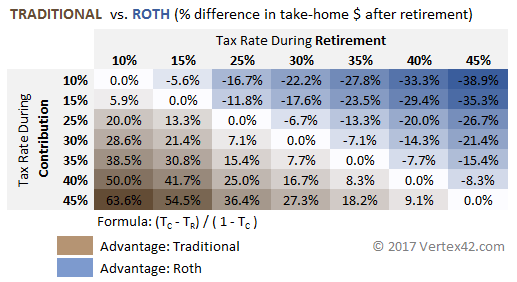

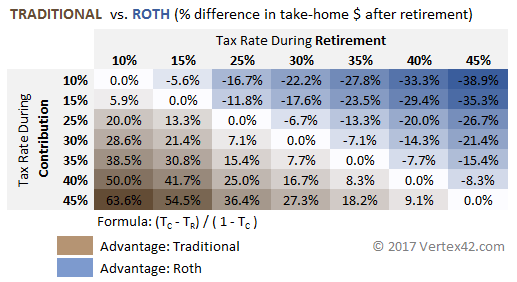

The tax brackets standard deduction and the 0 capital gains tax cutoff point for single and married filing jointly filing statuses will go up in 2023. Or if you dont mind giving up the IRAs immediate tax deduction in. The table below shows the tax bracketrate for each income level.

And annual contribution limits are sizeable20500 for tax-year 2022 plus a 6500 catch-up for those age 50 or older. An exception to this though is a Roth 401k which you fund with after-tax money. For 2019 the Federal tax brackets are very similar to what you saw in 2018.

A 401k is a tax-deferred retirement account you can often get through your employer. In this case your net earnings from self-employment is defined as your businesss profit minus the deduction for one half of your self-employment tax. To determine the amount of his plan contribution Joe must use the reduced plan contribution rate considering the plan contribution rate of 10 of 90909 from the rate table in Pub.

You only pay taxes on contributions and earnings when the money is withdrawn. Taxpayers can choose either itemized deductions or the standard deduction but usually choose whichever results in a higher deduction and therefore lower tax payable. Solo 401k Contribution Calculator Self-employed individuals and businesses employing only the owner partners and spouses have several options for tax-advantaged savings.

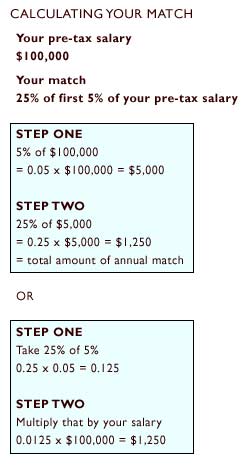

The bottom line is that all the tax bracket upper limits went up a little bit. For each dollar you save in your 401k your employer wholly or partially matches your contribution up to a certain. Plus many employers provide matching contributions.

Use the rate table or worksheets in Chapter 5 of IRS Publication 560 Retirement Plans for Small Business for figuring your allowable contribution rate and tax deduction for your 401k plan contributions. An employee contribution of for An employer contribution of 20 of your net earnings from self-employment and. With a traditional IRA you may be able to take a tax deduction for the money you put into the accountEarnings in the account are untaxed.

Your 401k plan account might be your best tool for creating a secure retirement. A 401k match is money your employer contributes to your 401k account. Use this calculator to see how increasing your contributions to a 401k can affect your paycheck and your retirement savings.

Withdrawing an amount less than what is allowable as a medical expense deduction. Solo 401k plans also allow you to make. Your principal may be subject to taxes on dividends and capital gains as it grows.

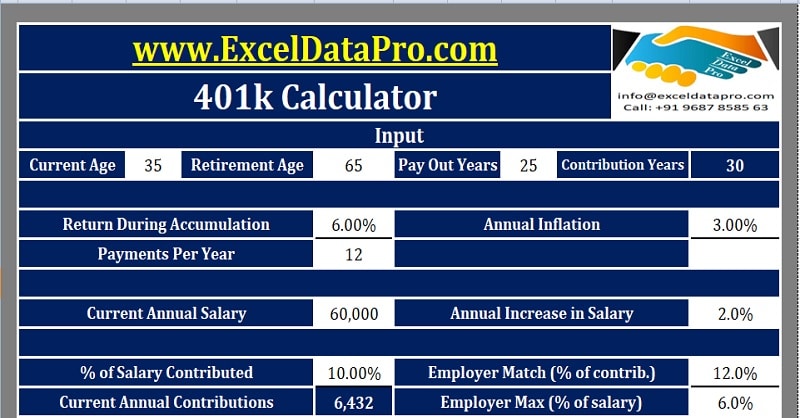

Free 401K calculator to plan and estimate a 401K balance and payout amount in retirement or help with early withdrawals or maximizing employer match. IRAs come in several variations. The amount of contribution for himself to the plan.

You get a tax deduction essentially letting you deposit pre-tax dollars. That means depending on your age you could contribute up to 27000 in 2022. A Solo 401k plan a SEP IRA a SIMPLE IRA or a Profit Sharing plan.

When you withdraw money you pay income taxes on the earnings and on any contributions that you took a deduction for. Get it while you still can. Qualified withdrawals are tax-free.

For the tax year 2022 which youll file a return for in 2023 that limit stands at 20500 which is up 1000 from the 2021 level. Solo 401k contributions are tax deductible. See also Calculating Your Own Retirement Plan Contribution.

You contribute money to it customarily as a regular deduction from your paycheck. You dont have to pay taxes on earnings contributed to a 401k at the time you make them. To reap those tax benefits youll need to observe contribution income and deduction limits set by the IRS.

Contribution limits for employer-based 401k accounts are higher than for traditional and Roth individual retirement accounts IRAs. The combined contribution limit for all of your traditional and Roth IRAs is 6000 in 2022 7000 if age 50 or older. And remember to claim the Solo 401k deductions on your tax return.

There are some slight changes but nothing major like we saw from 2017 to 2018 with the Trump Tax Cuts and Jobs Act. You may get an upfront tax deduction. Dont miss out on this chance to claim that contribution and pay less in taxes.

The IRC Section 164f deduction which in this case is ½ of his SE tax 14130 x ½. Regularly-Taxed Account 401k You pay income tax and then make your contribution with post-tax dollars. 6000 respectively for 2022and there are additional restrictions to be mindful of.

A catch-up contribution of for if you are 50 or older. The same annual contribution limits of 19500 or 26000 for. 2022 2023 401k 403b 457 IRA FSA HSA Contribution Limits.

Doing The Math On Your 401 K Match Sep 29 2000

401 K Calculator See What You Ll Have Saved Dqydj

After Tax Contributions 2021 Blakely Walters

I Created A Little Calculator To Figure Out Exactly What My 401k Contribution Election Should Be To Front Load It Early Each Year Reach The Annual Max And Still Get The Full

Paycheck Calculator Take Home Pay Calculator

Free 401k Calculator For Excel Calculate Your 401k Savings

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Traditional Vs Roth Ira Calculator

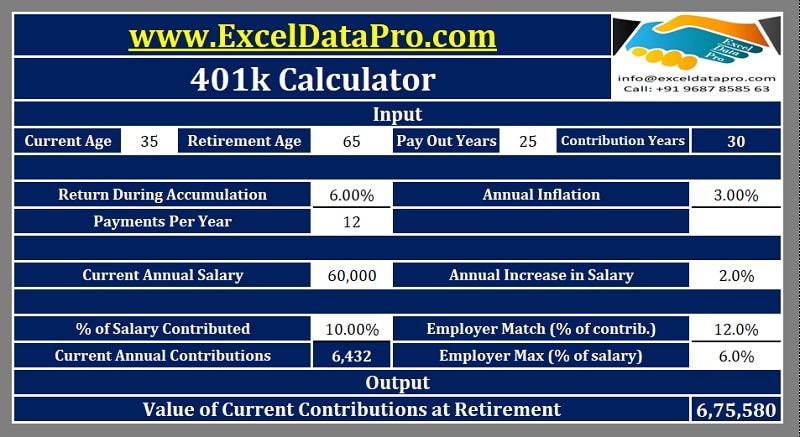

Download 401k Calculator Excel Template Exceldatapro

Download 401k Calculator Excel Template Exceldatapro

Traditional Vs Roth Ira Calculator Roth Ira Calculator Roth Ira Money Life Hacks

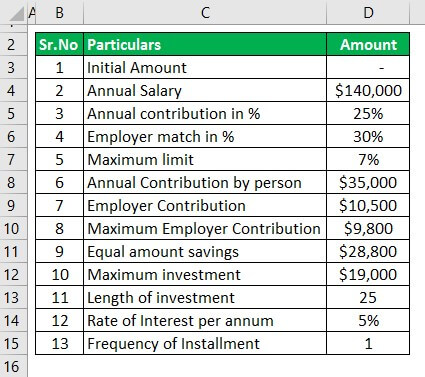

401k Contribution Calculator Step By Step Guide With Examples

401k Calculator

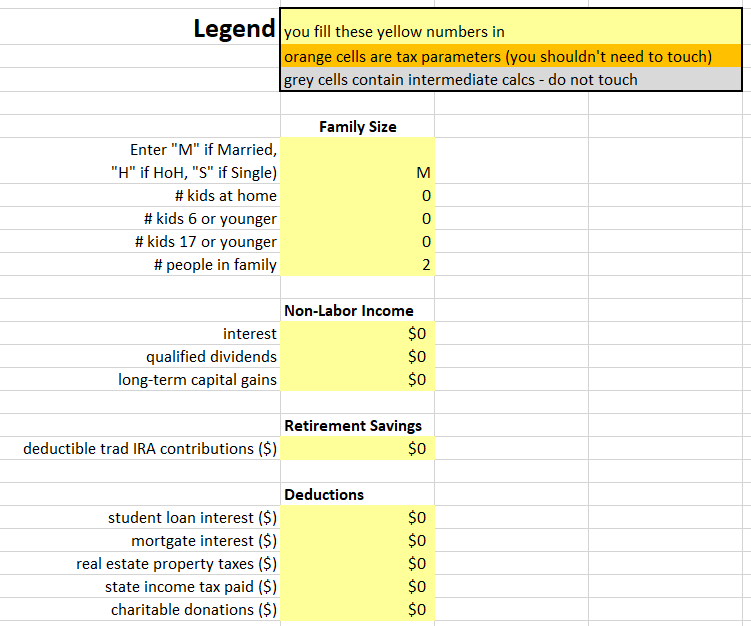

2021 Tax Calculator Frugal Professor

Retirement Services 401 K Calculator

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal